Table of Contents

ToggleProp Firms with Demo Accounts (Quick Take)

In today’s market the phrase prop firm usually refers to two models. Traditional prop desks provide live capital, a risk seat, and an employment style relationship. Evaluation based funding programs sell a rules based challenge, place you on a simulated account, and pay out from simulated profit according to their terms. Some programs state that selected traders may have trades copied to live capital at the firm’s discretion. The existence of a simulation does not make a firm fake. What matters is clear disclosure, prompt and reliable payouts, and stable rule sets that match what you plan to trade.

What Are Proprietary Trading Firms?

Proprietary trading firms deploy their own capital to generate trading profits. The evaluation segment operates more like a service. You pay for access to a simulated account with defined rules. If you meet the rules, the firm shares simulated profits with you and may decide to mirror or copy your trades to a live risk book. This is different from a salaried trader role at a legacy prop shop.

How Modern Evaluation Prop Firms Work

Typical flow

Evaluation or challenge: You trade a simulated account with strict risk rules. Passing often requires a profit target while staying within drawdown and news rules.

Funded stage: Many programs keep you on simulation for your platform while calculating payouts from simulated profit and loss. Some firms selectively copy trades to live capital.

Profit split: Terms specify the share, timing, buffers, and any payout caps.

This contractor style program can be practical for firms and traders, since it scales to large populations without exposing live capital to thousands of beginners.

Are Prop Firms with Demo Accounts Real?

They can be. A legitimate program states clearly that the account you trade is simulated, describes the payout schedule in writing, and explains whether and how top performers may be copied to live risk. Look for rule pages, help center articles, and terms that match the marketing pages. The more explicit the site is about simulation and payouts, the safer your expectations will be.

Execution 101: How Orders Are Filled

Simulation cannot capture everything that happens in a live order book. Depth, latency, partial fills, and slippage are hard to model perfectly. Some prop programs try to narrow the gap with execution logic that references market data and with post trade benchmarks such as VWAP. Treat those models as approximations. You are preparing for live conditions, not a video game.

Demo Execution Mode Explained

You may see phrases like fully simulated, demo, or simulated feed. High quality disclosures clarify that evaluation and funded stages can remain simulated for your terminal. The firm may copy certain traders’ signals to an internal live account. Payouts are calculated from simulated profit based on the terms you agree to. That structure lets firms screen for consistency while controlling risk.

VWAP Execution in Simulated Environments

VWAP, short for volume weighted average price, is a common benchmark for execution quality. If your average fills beat or lag VWAP, you gain a rough sense of whether your approach would face meaningful drag when orders hit a live book. In a simulated environment VWAP is not a promise of fill quality. It is a yardstick you can use to estimate execution realism and to compare sessions and instruments.

Pros: Why Firms Use Demo Accounts

Risk reduction: Firms can evaluate many traders without risking principal capital.

Consistency filter: Structured rules surface traders who follow a plan under pressure.

Scalability and cost control: Simulation scales across time zones and platforms at lower cost.

Data for decisions: Performance data helps firms decide whom to mirror to live risk.

Cons: The Hidden Pitfalls for Traders

The emotional profile of demo trading is not the same as trading when your orders hit a live book. Many traders develop over confidence because simulated losses feel painless and simulated fills can look cleaner than real fills. When a firm starts to mirror your signals or when you transition to live routing, expect slippage, partials, and spread costs that are larger than you saw in practice. Rule friction is another risk. News restrictions, trailing drawdowns, and product bans can conflict with a strategy that works in normal conditions. Finally, payout calculations are defined by the terms. Read them so you know about buffers, payout windows, and any caps.

Common Demo Account Mistakes

New and experienced traders sometimes treat evaluation phases like arcade games. Without a trading journal they cannot separate edge from luck. Sizing often ramps up too quickly because larger simulated positions do not feel dangerous. Many ignore execution metrics such as VWAP slippage and average spread, so the first encounter with live conditions is a shock. Others remove cooldowns, chase losses, or change setups mid challenge and end up with a sample of trades that cannot be analyzed.

Rules You Must Master Before a Challenge

Daily and overall drawdown: Understand fixed versus trailing mechanics and the exact reset rules.

Profit targets and time: Some firms require targets within a time window, others do not.

News filters: Know which economic releases are restricted and how far from the release you must stop trading.

Products and hours: Confirm allowed instruments, session times, and holiday schedules.

Prop Firm with Demo Accounts

Here is the core point in plain language. Prop firms with demo accounts are normal in the modern funding landscape. Treat the program as a rules based simulation that may lead to mirrored live risk if you are consistent. Choose firms that are transparent about simulation, payouts, and the conditions under which they copy to live. Use the demo phase to refine execution and risk so the jump to live conditions, if it comes, is not a cold shower.

Strategy Lab: Testing Without Real Risk

Run walk forward tests across out of sample months.

Validate entry criteria and exit logic on multiple timeframes.

Pre commit to a risk budget such as 0.25 to 0.5R per trade.

Write a pre mortem for how the challenge could fail and how you will avoid that failure.

Track benchmark metrics like VWAP slippage, average spread, and holding time.

Designing a Research Driven Trading Plan

Your plan should define the market regimes you trade, for example trend, range, or calm news environments. Document your setups with screenshots and a checklist. Specify entry and exit rules with R multiple targets and clearly defined invalidation. Add hard risk controls such as a maximum number of consecutive losses, a daily stop, and a weekly stop. Finish with a record keeping system that pairs a journal with tagged screenshots so you can audit mistakes and improve.

How to Simulate Realistic Emotions

Trade close to your intended live size during the evaluation. Impose soft consequences for rule breaks, such as pausing the next session or skipping a weekend treat. Enforce cooldowns after a loss and do not re enter immediately. Use a loss ladder. Reduce size after a red day and increase it only after you have met a predefined performance threshold.

Set Smart Goals for Your Demo Phase

Use a target win rate band, for example 40 to 55 percent, paired with an average R greater than or equal to 1.5.

Fix your risk to reward before the trade and do not move stops.

Control variance with a cap on daily trades and with rules for when to shut down after a streak.

Track journal KPIs such as time of day, setup performance, and mistake rate.

Live vs Demo: What Changes After Funding?

Expect more slippage, partial fills, and wider spreads around news or thin liquidity. Latency will vary by platform, broker, and venue. Treat the funded stage as a new environment that requires tighter discipline and more conservative expectations until your data proves otherwise.

Copying to Live: How Some Firms Bridge the Gap

Many programs outline a pathway that starts with simulation, then copies selected traders to internal live accounts via an automated process, and later may offer a seat with live routing after deeper review. Copying is discretionary and typically depends on stability, rule adherence, and risk metrics that the firm tracks internally. A funded badge on your dashboard does not guarantee live execution on your terminal.

Regulatory and Legal Landscape

Evaluation programs are not your broker. They sell an evaluation service with published terms and rules. The legal and regulatory context changes over time and varies by jurisdiction. To stay safe, read firm authored terms, review help center disclosures, and check reputable news coverage when major cases affect the industry. Keep your expectations tied to official documents, not social media claims.

Due Diligence Checklist

Disclosure clarity: The site should state plainly whether your account is simulated and how payouts are calculated.

Terms and rules: Read payout math, buffers, caps, timing, holidays, and refund policy.

Reputation research: Look for independent reporting and for a consistent track record of paying.

Support and contact: Real addresses and service level expectations help establish trust.

Data security: Check payment processors and how your information is stored.

Freshness: Rule pages should be current and dated.

Transparency Red Flags

Be wary of marketing that calls your terminal live while the terms say simulated. Watch for moving goalposts such as sudden rule changes during an evaluation. Repeated payout delays, vague chargeback statements, and a lack of firm authored FAQs or legal terms also indicate risk.

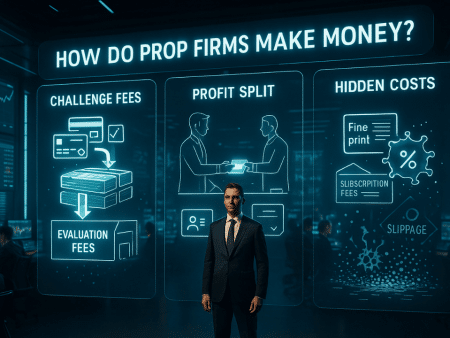

Costs and Math of Passing vs Paying

Your break even depends on the fee structure. One time fees and monthly subscriptions have different implications for expected value. Consider the realistic probability of passing, the time to first payout, and typical payout size after rule constraints. Resets can be useful, but frequent resets will erase small statistical edges. Plan your budget before you start.

Risk Management That Actually Works

Risk per trade: Consider 0.25 to 0.5R during evaluation and 0.5 to 0.75R once stable.

Daily stop: 1 to 1.5R to respect daily drawdown rules.

Weekly stop: 3 to 4R to protect the account when variance spikes.

No trade zones: Avoid thin liquidity windows and the minutes around restricted news.

Execution Benchmarks You Can Track

VWAP slippage: Compare average fill to VWAP to estimate possible drag under live routing.

Spread cost: Track average spread by session and instrument.

Reject rates and latency: Record platform rejects, delays, and disconnections so you can choose better sessions.

Choosing a Legit Prop Firm

Confirm that the program states clearly that your trading is simulated unless and until the firm chooses to copy you to live risk.

Read both the evaluation rules and the funded stage rules and check for a documented path to any live funded account that may exist.

Look for independent reporting or long running community discussions that show consistent payouts.

Verify payout policies in writing and confirm timing and caps.

Start with the smallest plan that tests your process without stressing your finances.

Competitor Analysis: What Others Do Not Tell You

Many roundups present funded accounts as if all of them route live by default. In practice most programs keep the trader on a simulated terminal, calculate payouts from simulated profit, and decide separately whether to copy signals to a live book. This guide focuses on clear terminology, rule awareness, and practical testing so you can make a decision that fits your strategy and risk tolerance.

Conclusion and Next Steps

Choosing to work with prop firms with demo accounts can be a smart path if you treat the evaluation as a serious simulation with real discipline. The right approach is simple. Read every line of the terms, map your strategy to the rules, and measure execution with benchmarks such as VWAP and spread so you know what to expect if the firm later mirrors you to live risk. Use the demo phase to build habits that survive the transition. When you find a transparent program that pays on time, scale slowly and let your data lead.

Call to action: Recheck the rule pages, set your risk limits, and start with the smallest transparent program that fits your edge today.

Not every proprietary trading firm relies on demo accounts for assessments, though many do. Some firms set up sample trading accounts to check a trader’s ability before granting live funds, while others mix sample and live trading tests. The main aim of using sample accounts is to lower risk ensuring that only capable and careful traders move to funded accounts. Yet a small number of firms offer instant funding so traders may bypass evaluation and use real money, though these options often cost more or carry stricter risk rules.

Trading on a sample account does not bring in real money, yet prop firms use these accounts to review traders. If a trader meets the profit targets and follows risk rules during the sample phase, the trader earns a funded account where real money becomes possible. In this way passing a sample test can open true money opportunities but the sample phase does not pay out.

Sample accounts copy live market conditions but do not match them fully. In a sample setting orders do not reach the live market. This means matters like liquidity, slippage or changes in spread do not show correctly. Some firms use methods like Volume Weighted Average Price to make the sample test seem closer to live trading. Traders should note that feeling differences and order handling contrasts between sample and live trading can affect performance when moving to real accounts.

Many traders do not pass prop firm tests not because they lose money but because of strict risk rules. Common causes for failure include breaking daily loss limits taking too large positions, not closing trades by market close or breaking set trading rules. Traders sometimes ignore the mental differences between sample and live trading. In a sample setting there is no real pressure but in live trading fear, greed or doubt affect choices. The move from sample to live accounts calls for firm discipline and steady methods, which many traders find hard to keep.

About the Author

I’m Ronan Edwards, a funded futures trader and content creator with over 7 years of experience across cryptocurrency and financial markets. My journey began in the 2017-2018 crypto boom, where I laid the foundation for my trading approach, later expanding into forex, gold, and meme coins.