In the high-stakes world of trading, one question sparks more curiosity than a volatile Tesla stock chart on earnings day: How much do prop firm traders make? Whether you’re a curious newcomer, a struggling retail trader, or a seasoned investor eyeing a switch, the financial potential within proprietary (prop) trading firms is enough to get anyone’s heart racing.

Let’s dive into the fascinating, sometimes misunderstood, and highly rewarding domain of proprietary trading — and break down the dollars and cents you can expect to pocket.

Table of Contents

ToggleWhat Is a Prop Firm Trader?

Understanding Proprietary Trading Firms

Proprietary trading firms, or “prop firms,” are companies that invest their own capital by hiring or contracting skilled traders. Unlike traditional hedge funds, where you manage other people’s money, here you trade the firm’s funds — and keep a share of the profits. Think of it as a symbiotic relationship: the firm gets growth, you get income.

Why Firms Provide Capital to Traders

The firm’s capital is like fuel — high-octane and ready to go. Why? Because firms understand that skilled traders can significantly outperform the market. Rather than risk solo trades, they leverage diverse strategies through multiple traders, hedging their overall risk.

How Proprietary Trading Works

From day trading forex to scalping futures or swing trading stocks, traders at prop firms operate in real-time markets using advanced platforms. You’re given a trading account (often after passing a challenge), and the rest is up to your skill, discipline, and strategy.

The Business Model of Prop Firms: Profit Split vs. Challenge Models

Most firms operate on a profit-split model — usually a 70/30 or 80/20 split in favor of the trader. Some also have a challenge-based entry model, where traders must pass an evaluation phase (often with simulated accounts) to access real funds. This is how firms screen talent without risking capital on unproven strategies.

How Do Prop Firm Traders Make Money?

Performance-Based Compensation Structures

Prop traders earn based on performance, not hours. Think of it like a sports contract: if you deliver wins, you get paid — often handsomely. Unlike salaried jobs, your income directly correlates with your ability to generate profits. There’s no cap, just your skill (and maybe your nerves).

Profit Split Model Explained

In most prop firms, traders earn a percentage of the profits they generate. For example, with an 80/20 split, if you make $10,000 in a month, you walk away with $8,000. The firm keeps the rest. Some top-tier firms offer even higher splits or tiered bonuses for consistent profitability.

Impact of Losses on Payouts

Here’s the flip side: losses impact payouts significantly. If your account hits a drawdown limit, your payout can pause, your account may get reset, or in challenge-model firms, you might lose funding altogether. Risk management isn’t just a nice-to-have; it’s your financial lifeline.

Payout Frequency and Terms

Payouts vary by firm. Some pay weekly, others bi-weekly, and many stick to monthly. Most require a minimum profit threshold or a no-withdrawal period before releasing funds. Always read the fine print — especially if you’re eyeing a firm with aggressive marketing claims.

Examples of Realistic Payout Scenarios

- Beginner Trader: Makes ,000/month; with a 70% split, earns $1,400.

- Intermediate Trader: Pulls in $5,000/month; with an 80% split, earns $4,000.

- Elite Trader: Nets $20,000/month; with an 85% split, takes home $17,000.

Of course, these numbers vary based on strategy, market conditions, and consistency. But the potential is real.

Prop Firm Trader Salary & Income Expectations

Base Salary vs. Commission

Most prop traders work on commission — no base salary. However, institutional prop desks (especially in major cities) may offer a base salary plus bonuses. Challenge-based firms, by contrast, rarely offer guaranteed pay.

Average Monthly Income by Experience Level

- New Traders: ,000–$3,000 (after profit splits)

- Intermediate Traders: $3,000–$8,000

- Experienced Traders: $10,000–$25,000+

- Top 1% Performers: $50,000+/month

Yes, those six-figure traders exist — but they’re unicorns with iron discipline and tons of screen time.

High-Income Potential of Top Traders

Top prop traders often diversify into multiple accounts, trade multiple assets, and automate strategies. They treat trading like a business, reinvesting profits, optimizing systems, and learning continuously. This business mindset is key to long-term high income.

Consistency & Long-Term Profitability

Consistency > one-time big wins. Prop firms value traders who can show month-after-month stability, even if profits are modest. A trader who nets $5,000 a month consistently is worth more to a firm than one who hits $50,000 once, then burns the account.

Prop Firms With the Most Lucrative Payouts

Top-tier firms in 2025 like FTMO, The5ers, and Funded Next offer attractive payout structures, scaling plans, and performance bonuses. Many even offer 90%+ profit splits to top performers.

Key Factors That Influence Earnings

Skill Level and Trading Experience

Simply put: the better you are, the more you make. But “better” means more than just calling trades. It includes psychology, strategy refinement, and execution under pressure. Experience shapes every element of performance.

Risk Management and Performance Metrics

You could have a 90% win rate and still lose money with poor risk management. Metrics like max drawdown, risk-to-reward ratio, and consistency score heavily in your payouts and longevity.

Market Volatility and Economic Conditions

Increased volatility often equals more opportunity — but also more risk. Economic cycles, news catalysts, and even geopolitical tensions affect trading conditions and outcomes. Savvy traders learn to adapt and capitalize.

Firm Reputation and Resource Access

Established firms provide access to advanced trading tools, performance coaches, community forums, and scaling plans. These resources can directly impact your earnings and learning curve.

Top Strategies to Maximize Prop Trading Income

1. Create a Data-Driven Trading Plan

Your trading plan should be more precise than a NASA launch sequence. Document everything — entry criteria, exit signals, position sizing, emotional triggers. Backtest rigorously. Measure performance. Adjust.

2. Master Advanced Risk Management Techniques

Learn to think in probabilities. Set daily loss limits, cap drawdowns, and use trailing stops. Remember: protecting capital is more powerful than chasing trades.

3. Stay Adaptive to Market Changes

Markets are living beasts — they evolve. A strategy that works in high volatility might fail in sideways markets. Constantly review performance and tweak your approach.

4. Focus on Niche Markets or Asset Classes

Some traders dominate micro futures, others specialize in Nasdaq scalping or premarket crypto. Find your edge and double down.

5. Leverage Trading Technology and Automation

Automation tools like TradingView alerts, MT5 EAs, or NinjaTrader bots can help reduce human error, improve consistency, and trade faster than you blink.

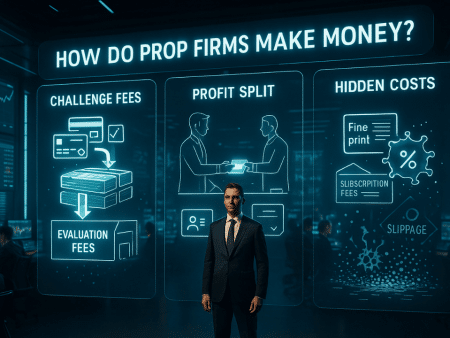

How Do Prop Firms Make Money?

Revenue Streams: Challenges, Subscriptions & Profit Sharing

Firms earn through:

- Challenge fees (evaluation stage)

- Monthly platform fees

- A cut of profitable traders’ earnings

- Upsells to advanced funding programs

Monitoring and Managing Profitable Traders

Firms use advanced analytics to monitor performance. Risk managers intervene if traders go off-plan. Their goal? Keep winning traders funded, not boot them.

Where Do Prop Firms Source Their Capital?

Funding often comes from private investors, institutional partners, or internal profits. Some use synthetic demo models until traders prove profitability, then route trades to live liquidity providers.

Is Becoming a Prop Trader Worth It?

Pros and Cons of Working with a Prop Firm

Pros:

- No personal capital required

- High-income potential

- Structured growth and mentorship

- Professional trading tools

Cons:

- No guaranteed income

- Strict risk rules

- Psychological pressure

- Initial challenge fee

Career Longevity and Growth Opportunities

Consistent traders can scale to six-figure accounts, join the firm’s core team, or even start their own prop firms. Prop trading isn’t a job; it’s a career — and for some, a lifestyle.

How to Choose the Right Prop Firm

Look for:

- Transparent rules

- Fair profit splits

- Reliable payout history

- Positive community feedback

- Educational support

Platforms like Trustpilot and ForexPeaceArmy can reveal the good, bad, and shady.

Conclusion: What Can You Really Expect as a Prop Firm Trader?

How much do prop firm traders make? The answer is wildly individual. It ranges from modest side income to seven figures annually. The best traders see this not as fast money, but as a disciplined business. If you bring skill, patience, and adaptability, the sky (and your risk tolerance) is the limit.

FAQ

Most don’t earn a fixed salary. However, average monthly take-home ranges from $2,000 to $8,000 based on experience.

Yes — but not all. Top firms with proven track records and transparent payouts are legit. Always research before committing.

Elite traders can make $20,000 to $100,000+/month, depending on scaling, strategy, and firm.

Master risk management, focus on one market, automate where possible, and track every trade like it’s gold.

If they’re salaried (rare), maybe. Otherwise, no. Payouts are typically based on net monthly profit.

About the Author

Andrew Edwards is the co-founder of SecretsToTrading101 and has years of practical experience in online trading, prop firm evaluations and financial content review. He specialises in helping traders understand trading rules, challenge requirements and platform conditions so they can make informed decisions. Andrew oversees the accuracy of our prop firm guides and ensures all information is reviewed against current programme terms and risk standards.