Table of Contents

ToggleIntroduction to Proprietary Trading Firms

If you have ever wondered how professional traders earn big without using their own capital, you are probably thinking about proprietary trading firms. Often referred to as “prop firms,” these companies allow qualified traders to operate with firm-owned funds in order to generate profit. Unlike brokers who earn commissions from clients, prop firms generate revenue directly from their own trades.

What makes these firms especially interesting is that they take full responsibility for both the risks and the rewards of their trading activity. They do not trade on behalf of clients. Instead, they back traders who show skill, discipline, and profitability. In return, traders receive a share of the profits and access to ever-larger trading accounts.

What is a Proprietary Trading Firm?

A proprietary trading firm is a financial company that uses its own money to trade on financial markets. They do not manage client portfolios. Their primary goal is to find traders who can profit from the market consistently while managing risk. The firm then allocates capital to those traders based on performance and rules.

These firms often have their own trading platforms, risk management systems, and educational programs. Some operate more like performance evaluation centers. They test traders through challenges or evaluations, and if you meet the criteria, you get funded.

Rather than earning money through fees or commissions, these firms profit by keeping a percentage of what their traders earn. It is a performance-driven business model where everyone benefits from profitable trades.

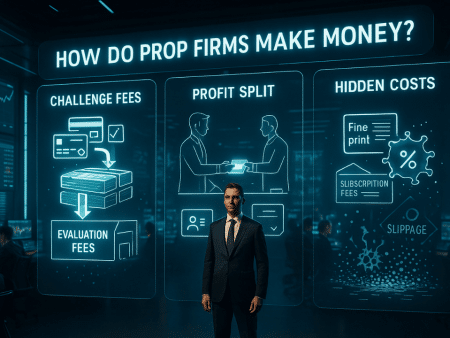

How Prop Firms Make Money

Prop firms make money in several ways. First, they earn a share of the profits from traders who use their capital. If a trader earns $5,000 and has a 70/30 profit split, the firm keeps ,500 and the trader receives $3,500.

Another revenue stream comes from evaluation fees. Many firms charge traders to participate in challenges or demos. This helps cover operating costs and ensures that only serious applicants participate.

Some firms also duplicate winning trades from their top-performing traders across multiple internal accounts. This allows them to scale successful strategies without relying on a single trader.

Advanced firms may also engage in arbitrage, market making, or algorithmic trading. These activities further diversify their income.

The Role of Prop Firms in Financial Markets

Prop firms play a crucial role in ensuring that financial markets stay liquid and efficient. Their constant buying and selling activity helps reduce bid-ask spreads and improves price discovery. This is especially important during volatile periods when traditional market participants may hesitate.

By deploying capital across various assets such as stocks, forex, futures, and crypto, these firms support global market functioning. They also innovate by testing new strategies, using AI and machine learning tools to stay competitive.

Their ability to quickly react to market changes often stabilizes prices. When others are uncertain, prop firms are frequently the ones placing large trades with calculated precision.

Now that we have covered the foundations, the next sections will explore how account size impacts performance, how to choose the right prop firm, how to manage risks, and more. I will continue writing the next part in the following message to ensure clarity and completeness.

Understanding Prop Firm Account Sizes

Why Account Size Is Important

The size of your trading account directly affects how much capital you can risk, how many positions you can open, and how large your trades can be. With a small account, you are limited to low-volume trades and fewer opportunities. With a large account, your potential profit increases significantly.

But here is the catch. A larger account can also amplify losses. If you are not experienced or disciplined, the risks can outweigh the benefits.

Typical Account Tiers

Prop firms offer different funding levels depending on trader skill, performance in evaluations, and risk management. Here is a quick overview:

Account Size | Who It Suits | Key Characteristics |

$10,000 – $25,000 | New traders | Low pressure, ideal for learning |

$50,000 – $100,000 | Intermediate traders | Allows for broader strategies |

$200,000 – $1,000,000+ | Experienced professionals | High risk, high reward potential |

Some firms also offer scaling plans where consistent profitability leads to increased funding over time. This rewards discipline and longevity in the market.

Benefits of Larger Funded Accounts

Greater Flexibility

Larger accounts let you diversify across multiple assets. You can hedge trades, run different strategies at once, and avoid over-leveraging any single position.

Increased Earnings

If you make a 3 percent monthly return, you earn $300 on a $10,000 account but $3,000 on a $100,000 account. The effort is the same, but the reward is much higher.

Risks and Drawbacks of Bigger Accounts

Emotional Pressure

Managing large sums of money can be mentally exhausting. A minor drawdown in a six-figure account may cause anxiety, even if it is well within your risk plan.

Higher Responsibility

With great capital comes great accountability. You need to follow rules more strictly, keep detailed records, and avoid emotional decision-making.

Mitigating Psychological Risks

Think in Percentages

Focus on percentage gains and losses rather than dollar amounts. This keeps your mind grounded and prevents emotional reactions.

Stick to a Trading Plan

A clear strategy, predefined stop losses, and routine reviews help maintain discipline. If your trading plan is solid, you will trust your decisions even during drawdowns.

Use Trade Copiers Wisely

If you manage multiple accounts or strategies, trade copiers allow you to automate consistency. This saves time and reduces manual errors.

Choosing the Right Account Size

Start Small, Grow Smart

If you are new to prop trading, begin with a smaller account. Prove you can manage it profitably. Once you are confident and consistent, scale up gradually.

Match Size to Strategy

Swing traders might need more capital due to longer trade durations and wider stops. Scalpers may thrive on smaller accounts with tight spreads.

How to Choose the Right Account Size for You

Assess Your Financial Goals and Risk Appetite

Choosing the right account size isn’t just about how big your dreams are, it’s about how comfortable you are when things go wrong.

Ask yourself:

- How much drawdown can I mentally and financially handle?

- Am I looking to grow steadily or swing for the fences?

- Can I survive emotionally if I hit the max loss on a $100K account?

If you’re sweating just thinking about it, start small. Build confidence and skill before you scale.

Pro tip: Just because a firm offers a $200K account doesn’t mean you should jump on it. Select the size that supports your current strategy and risk tolerance, not your ego.

Balance Strategy Fit with Scaling Opportunity

Different trading styles require different capital. For example:

Trading Style | Recommended Account Size |

Scalping | $10K–$25K (frequent, small moves) |

Swing Trading | $50K–$100K (longer holds, wider stops) |

Multi-Asset | $100K+ (diversification needs capital) |

Larger accounts also unlock scaling plans, so if you’re serious about trading long-term, pick an account with clear growth tiers and transparent rules.

Risk Management in Proprietary Trading

Let’s get one thing straight: Risk management isn’t a suggestion, it’s your survival kit.

The best traders aren’t the ones who make the most money. They’re the ones who stay in the game long enough to keep that money.

Key Risk Management Rules:

- Risk 1%–2% per trade, max.

- Set a hard daily loss limit (e.g., 5% of the account)

- Use proper stop-loss orders, hope is not a strategy.

- Trade fewer setups with higher conviction.

Percentage Thinking = Emotional Control

Focusing on % gains and losses makes it easier to stay objective. A $1,500 loss on a $100K account is just 1.5%. But if you obsess over the number, you’ll panic, revenge trade, and wreck your month.

Prop Firm Rules: Don’t Ignore the Fine Print

Every firm has slightly different rules. Study them. These rules are there not to trap you, but to save the firm from rogue traders.

Watch for:

- Daily drawdown vs. trailing drawdown

- Weekend holding policies

- News trading bans

Break one? You’re out. Game over.

Trade Copiers & Signal Groups: Your Secret Weapon

Many prop traders manage multiple accounts, either for themselves or clients. Enter trade copiers: software that replicates trades across multiple accounts in real time.

Benefits:

- Trade once, get paid multiple times

- Reduce screen fatigue and overtrading

- Automate consistent strategy application

What About Copying Pro Traders?

Some firms now let you copy top-performing traders within their network. It’s like having a hedge fund manager in your back pocket, only without the 2/20 fee structure.

Our top pick? Join verified signals groups or Discord communities where traders share setups, analysis, and performance stats.

(Remember: Transparency is key. If someone won’t show their MyFXBook or third-party verified stats, run.)

How to Choose the Right Prop Firm

Here’s a punchy checklist to help you avoid shady firms and find your trading home.

Criteria | Why It Matters |

Transparent Payout Policy | No fine print surprises |

Realistic Rules | Avoid trap-laden systems |

Scaling Program | Room to grow your funding |

Funded Trader Reviews | Real testimonials build trust |

Platform Compatibility | Match your tools and tech |

Regulation & Reputation | Especially important for payouts |

Conclusion: The Prop Trading Opportunity Awaits

What is a proprietary trading firm? It’s your gateway to trading large sums, developing elite strategies, and growing your skills under professional conditions, without risking your life savings.

But with great power comes great responsibility. The account size you choose, the firm you join, and the strategy you implement will shape your success. Choose wisely. Trade smart. And remember, it’s not just about winning trades. It’s about surviving long enough to keep placing them.

FAQs

Access to capital. You can trade larger sums and scale profits faster without risking personal funds.

No. Many firms offer beginner-friendly challenges or demo evaluations. But to pass, you’ll need discipline and a solid trading plan.

You can’t lose your own money—but if you break the rules or lose firm capital, you’ll lose your account.

Most are legit but not “regulated” like banks. Do your research. Stick to firms with strong reputations and verified payouts.

Most use evaluation accounts where your trades are monitored for consistency, risk control, and profitability.

Yes. Many full-time traders make a living trading funded accounts—especially those with scaling opportunities.

About the Author

Ian Cabral, Chief Operating Officer and co-founder of Secrets To Trading 101, leverages his expertise in computer engineering and extensive experience in forex trading to drive the technical development of cutting-edge tools, automated systems, and educational resources. Ian's work directly empowers traders to execute smarter, more informed decisions and achieve consistent success in the financial markets.